Regulatory Alignment Agent

Stay Compliant. Stay Confident.

Meet the first AI Agent built to replace your manual compliance checks

Stop chasing disclosures. Stop relying on third party data. Stop spending more time gathering evidence than analyzing risk.

Your AI Regulatory Alignment Agent works 24/7 to assess your global portfolio for alignment with disclosure based regulations like SFDR, CSRD, and TCFD. It creates a systematic and auditable process for reporting and gap analysis, so you and your team can focus on what matters most: strategic risk management.

Think of it as your intelligent, tireless compliance analyst. It automates evidence collection, links disclosures to requirements, and ensures your regulatory reporting is always accurate, complete, and defensible.

How It Works

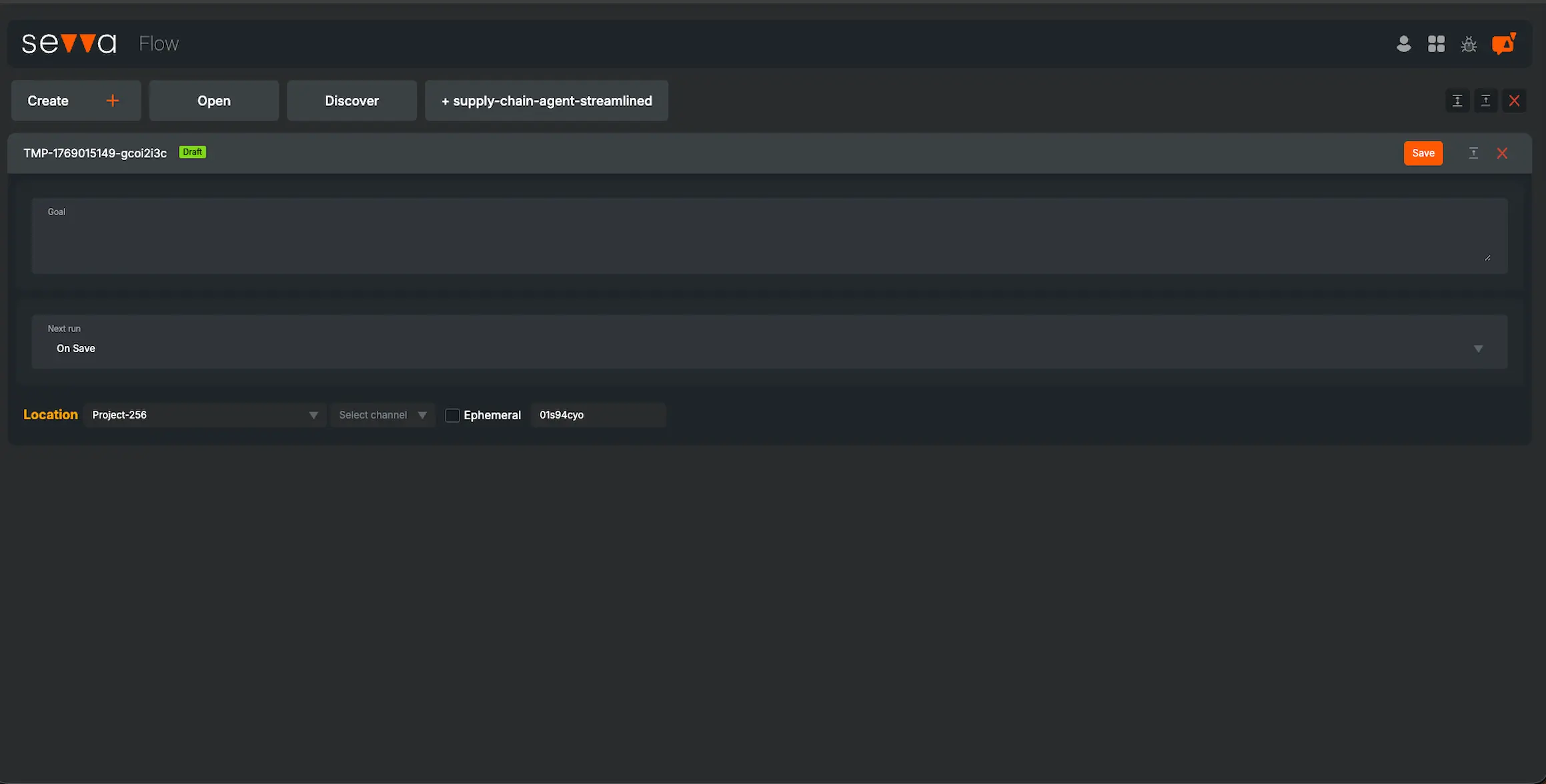

The Sevva AI Regulatory Alignment Agent functions as a fully autonomous digital compliance analyst. It ingests your portfolio holdings and the specific regulatory criteria you need to assess.

You define the regulatory requirements, from SFDR, PAI indicators to TCFD recommendations, and the agent then systematically scans thousands of public documents for every company in your portfolio. It silently extracts the exact text that serves as evidence, links it to the relevant requirement, and compiles a comprehensive, auditable report in the background without any manual work from you.

Quick Start Checklist

Define Regulatory Framework. Set up your regulatory criteria using our Criteria Builder. Translate SFDR, CSRD, TCFD, or any disclosure based regulation into assessable questions and requirements. Alternatively, let the AI Agent define the relevant criteria based on your required regulatory framework.

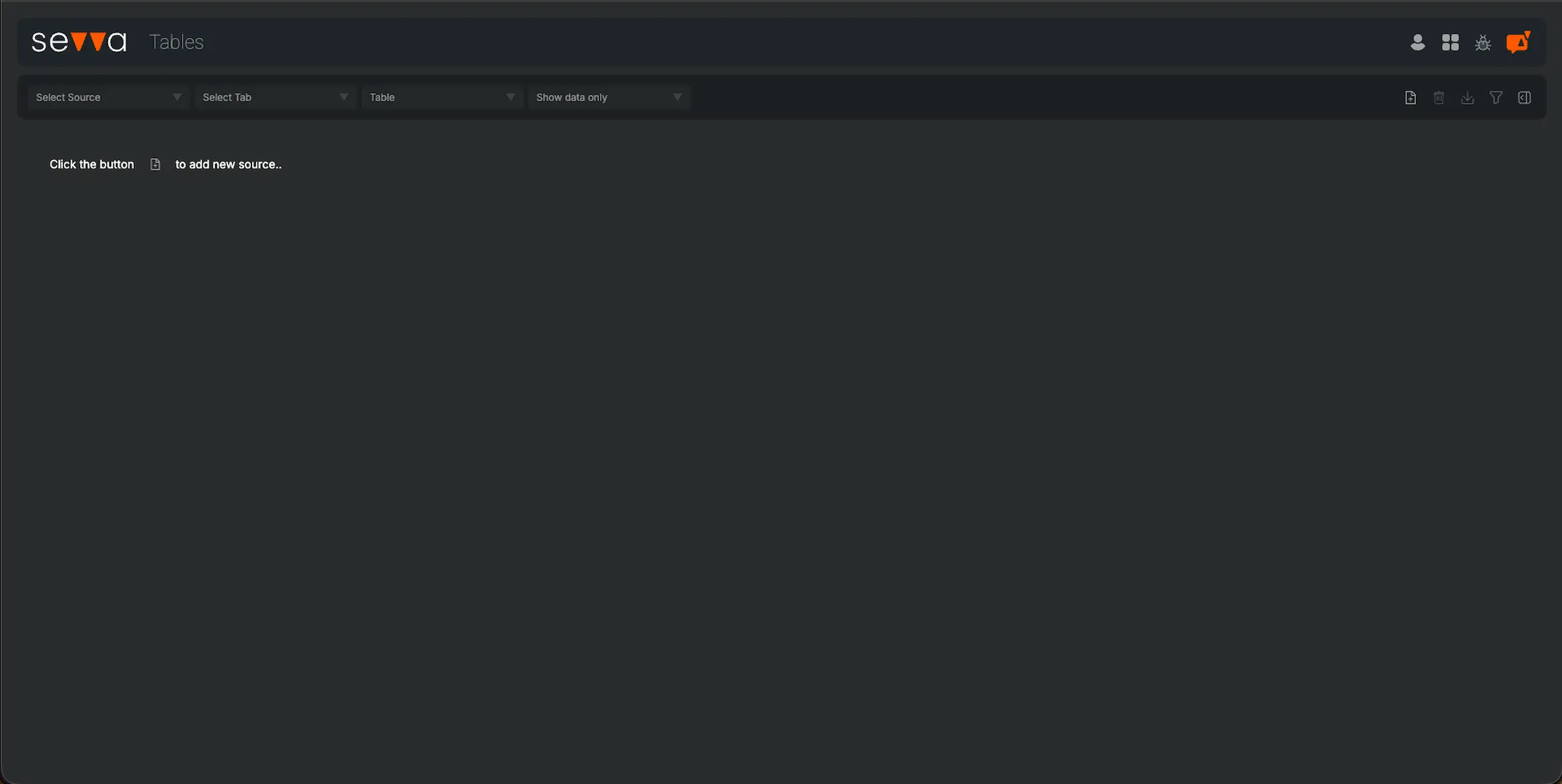

Upload Portfolio Holdings. Import your portfolio data including public and private holdings. The agent will automatically begin monitoring these companies' disclosure documents and regulatory filings.

Let the Agent Run. Once activated, the agent works continuously reviewing disclosures, extracting evidence, assessing compliance, and updating alignment scores as new information becomes available.

Review Compliance Reports. Access auto generated regulatory reports, gap analyses, and audit trails. Use the insights to address compliance gaps and prepare regulatory submissions with confidence.

Core Capabilities

Regulatory Criteria Builder. The Agent can help you to translate any disclosure based regulation, from SFDR and CSRD to TCFD, into a structured set of questions and criteria for the agent to assess.

Portfolio Wide Analysis. The Agent automatically assesses every holding in your portfolio against the defined regulatory criteria, ensuring 100% coverage and eliminating manual sampling.

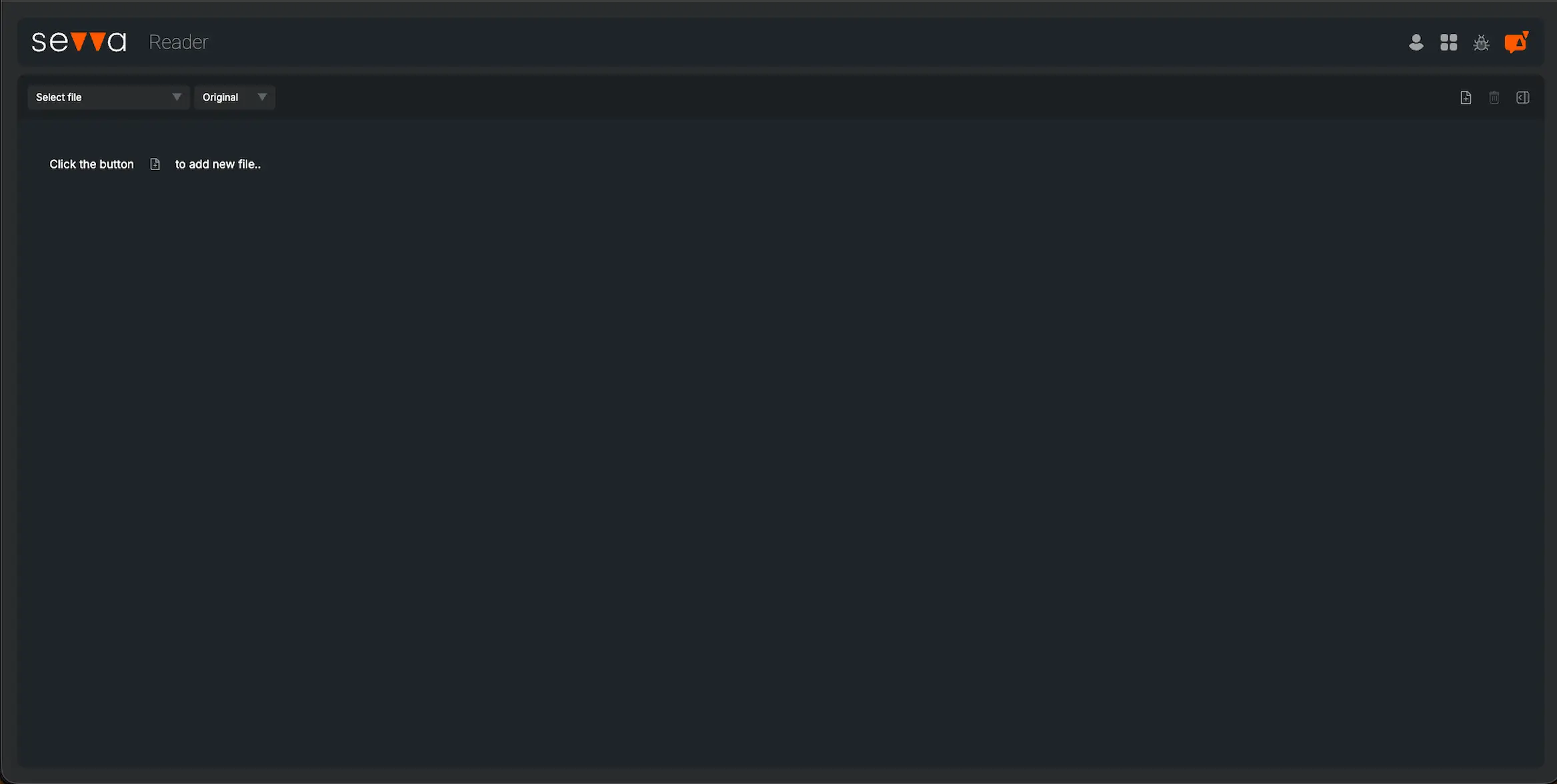

Automated Evidence Gathering. Instead of manually searching documents, the Agent scans thousands of disclosures to find and extract the exact text needed for reporting, saving hundreds of hours.

Audit Trail Transparency. Every piece of evidence is linked directly to its source document, providing a defensible, source traceable, and fully auditable record for regulators and internal stakeholders.

Regulatory Alignment Report Generation. The Agent synthesizes benchmarking results and strategic signals into a structured Regulatory Alignment Report, showing the alignment of your investment universe with your assessment criteria.

Who is it for

The Regulatory Alignment Agent is ideal for:

Heads of Risk & Compliance who need an automated, auditable way to manage global regulations.

ESG & Sustainability Teams tasked with gathering data for SFDR, CSRD, and TCFD reporting.

Portfolio Managers who want to understand the regulatory risk exposure of their holdings.

Internal Audit Teams that require a transparent, source traceable record of compliance activities.

Asset Managers, Banks, and Insurers who need to streamline compliance across vast and complex portfolios.

Why you should hire this Agent

Transform your compliance process from a burden into an advantage.

Eliminate Months of Manual Work. Reclaim hundreds of hours spent manually searching for disclosures and copying/pasting evidence. The agent reduces reporting cycles for regulations like SFDR from months to hours, letting your team focus on high value analysis, not data entry.

Reduce Regulatory Risk & Fines. Significantly decrease the risk of non compliance. By systematically assessing 100% of your portfolio and providing an auditable trail, you can face regulators with confidence and avoid costly penalties for incomplete or inaccurate reporting.

End Compliance Stress & Uncertainty. Eliminate the anxiety of looming reporting deadlines and auditor questions. Our agent provides a clear, evidence backed view of your alignment status, so you know exactly where you stand. Operate with certainty, not guesswork.

See the Risks Standard Checks Miss. Go beyond third party ratings and surface nuanced compliance gaps directly from source documents. The agent identifies risks that generic data providers are blind to, giving you a true, defensible understanding of your portfolio.

Gain a Strategic Advantage. Transform compliance from a reactive, cost center activity into a proactive, strategic function. Use the insights to inform investment decisions, communicate confidently with stakeholders, and build a reputation for best in class governance.

- Reduce compliance workload by 80%

- Complete regulatory reporting in hours, not months

- Eliminate manual evidence gathering

- Assess 100% of your global portfolio, not just a sample

- Get back 2-3 weeks every quarter for strategic work