Investment Research Agent

Your Research Edge. Built for Analysts. Driven by Insight.

You shouldn’t have to spend days combing through filings to find a single insight

While most analysts lose time on manual disclosure review, you can focus on what truly matters.

Meet your Investment Research Agent, the AI that automates foundational analysis to surface proprietary insights. Instead of relying on overworked analysts and incomplete data, our agent systematically reads the public disclosures of companies across the global investment universe. It tests your thesis, screens for opportunities, and gathers intelligence from primary sources at a scale no human team can match.

Think of it as a tireless junior analyst that never sleeps, continuously monitoring disclosures to surface opportunities, validate theses, and highlight risks before the market reacts.

How It Works

The Sevva AI Investment Research Agent functions as a fully autonomous fundamental research assistant that consumes and interprets public company disclosures worldwide.

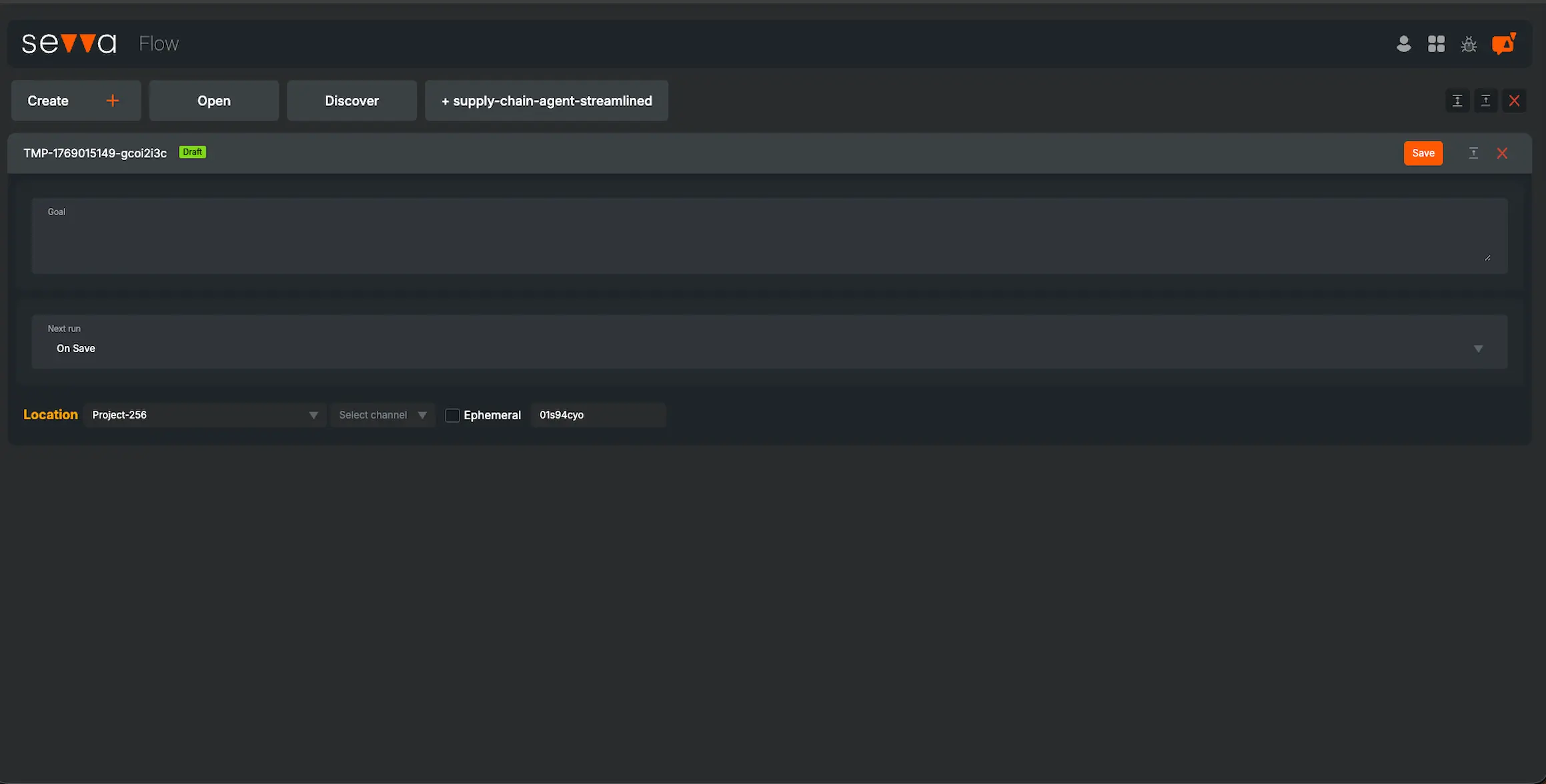

Define Your Research Criteria. Specify any fundamental or thematic questions across your global investment or watch list universe. Alternatively, let the AI Agent define the criteria for you.

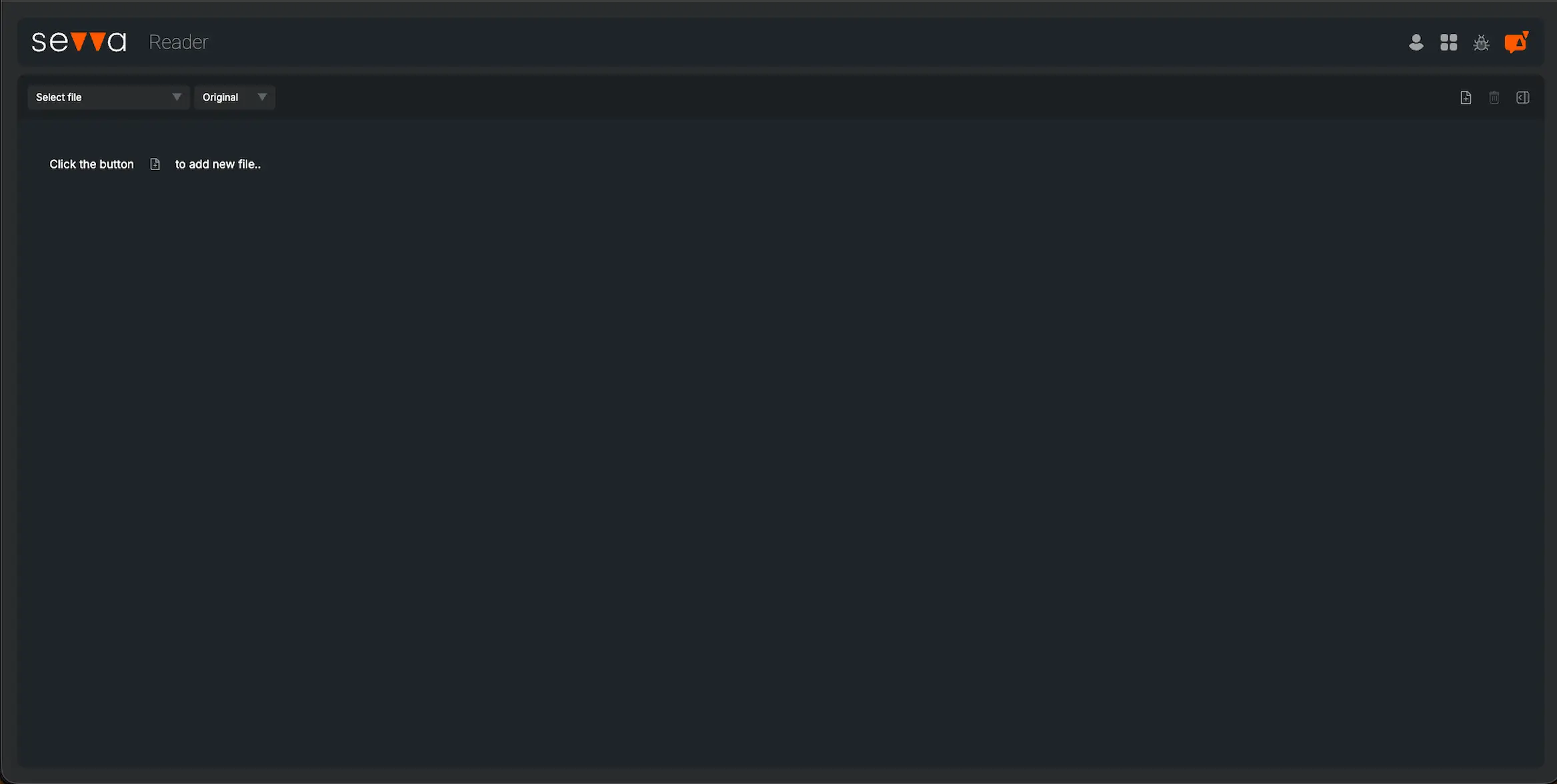

Automated Disclosure Analysis. The agent reads and interprets documents like 10-Ks, 20-Fs, Annual & Sustainability Reports, Investor Presentations, and Earnings Call Transcripts.

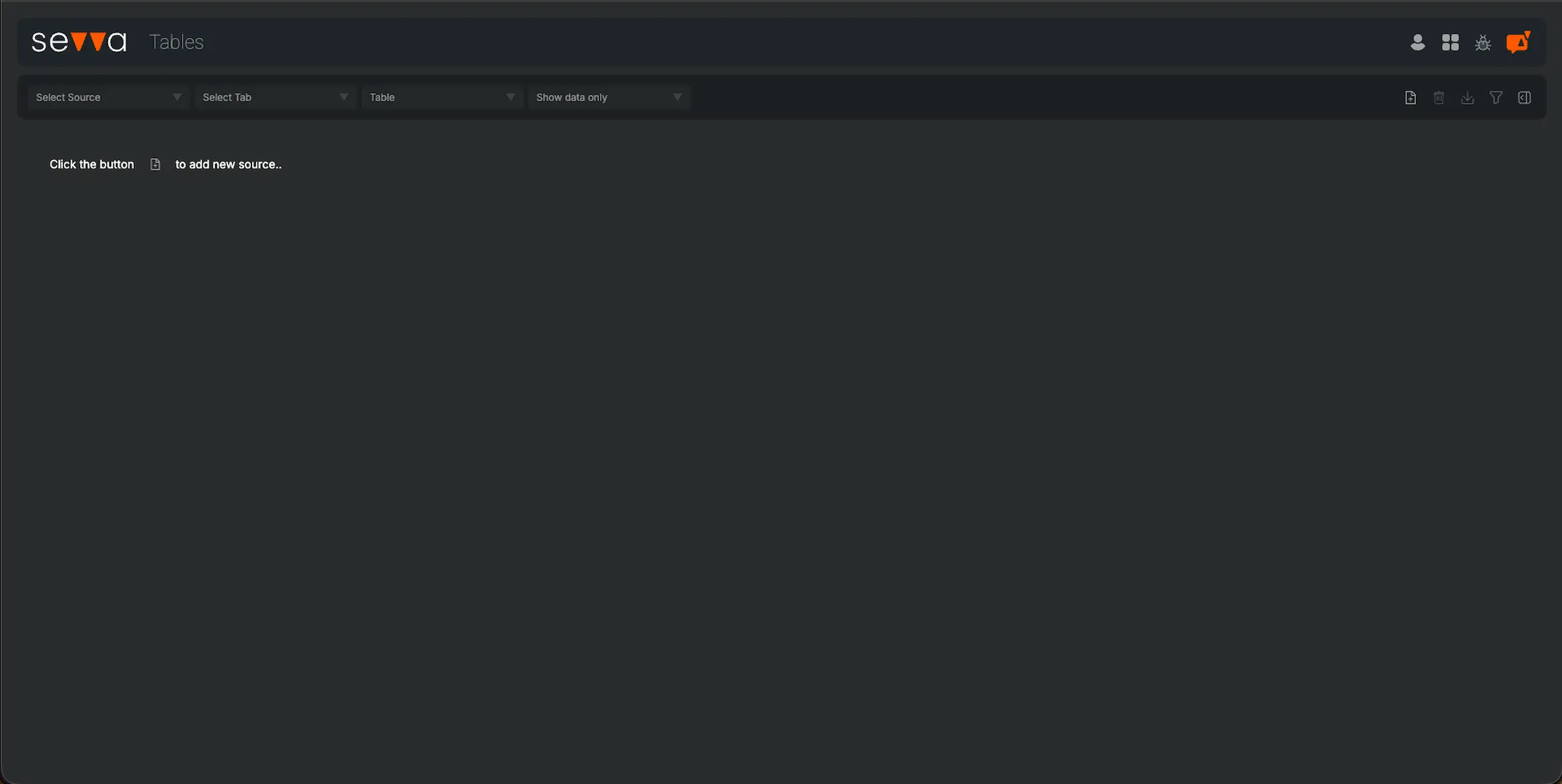

Structured Output. It returns narrative supported, fully auditable insight grids with source links, delivering evidence backed research summaries and key metrics.

Dynamic Company Profiles. Each covered company generates an auto updated “company card” containing deep insights about the company together with peer benchmarks.

Investment Research Report Generation. The Agent synthesizes benchmarking results and strategic signals into a structured Investment Research Report, showing the alignment of your investment universe with your assessment criteria.

Quick Start Checklist

Upload your holdings universe and watch list companies.

Define your research questions or thesis variables. Alternatively, let the AI Agent automatically define assessment criteria. Ask the agent to start reading, structuring, and mapping disclosures across your targeted universe.

Use the Output. Consume structured insights in your research management system, feed your investment model, or generate advisory deliverables.

Core Capabilities

Global Disclosure Intelligence. Access and analyze documents from over 200 million public and private companies globally. Identify opportunities across developed, emerging, and private markets faster than any traditional manual research.

Custom Research Criteria. Run systematic screens on custom factors, from margin expansion and supply chain risk to board diversity or carbon intensity metrics.

Automated Data Extraction. Reads and extracts relevant insights directly from company disclosures, financials, qualitative commentary and risk sections, providing fact based input for investment modeling.

Evidence Based Output. Every data point is accompanied by source citations, maintaining full audit trail transparency for compliance and review.

Who Is It For

The Investment Research Agent is designed for:

Buy Side Professionals Portfolio Managers, Analysts, and Heads of Research seeking fundamental and thematic insights.

Sell Side Analysts Equity, Credit, and Sector Specialists producing fast turnaround research.

M&A and Corporate Advisory Teams scanning strategic targets and benchmarking deals.

ESG and Sustainable Finance Teams extracting key ESG metrics and sustainability disclosure insights automatically.

Why You Should Hire This Agent

It unlocks the entire global public and private investment universe. Screen for opportunities across 200 million companies, far beyond the limits of traditional data providers, to find value in under analyzed markets like private equity and global small caps.

It tests any investment thesis at machine scale. Analyze tens of thousands of companies against hundreds of custom factors simultaneously and get the results and hours. This is work that would take human teams years to complete.

It generates proprietary alpha by finding what others miss. By systematically reading primary source documents, the Agent uncovers mispriced assets, hidden risks, and emerging trends before they become common knowledge.

It multiplies your team’s research bandwidth by 10x. Automate 80-90% of foundational data gathering and analysis, freeing your analysts to focus on high value strategic insights and decision making.

It delivers fully auditable, evidence backed research. Every insight is traced back to the source document, providing a transparent, compliant audit trail that stands up to scrutiny from portfolio managers, clients, and regulators.

In Summary

The Sevva AI Investment Research Agent is your scalable, intelligent research partner designed to help global investment teams move past manual reading and into truly systematic, evidence driven insight generation. It turns unstructured company text and structured data into knowledge, expands your research bandwidth, and continuously powers your edge in alpha generation and client intelligence.

- Save 5–6 full workdays per analyst monthly

- Expand research coverage by 5–10x

- Uncover mispriced opportunities

- Cover public and private markets

- Access 200M+ company disclosures