Customer Due Diligence Agent

What if you could onboard customers faster, without ever missing critical data?

Meet the first AI Agent built to transform your customer due diligence from a regulatory requirement into a strategic advantage

Stop letting manual checks delay onboarding. Stop relying on fragmented data and inconsistent reviews. Stop wasting analyst time chasing information instead of managing real risk.

Your AI Customer Due Diligence Agent works continuously to screen prospective customers for financial, reputational, and compliance risks across global data sources. By analyzing both internal records and external disclosures against your unique risk and policy criteria, it delivers a faster, more thorough, and fully auditable due diligence process.

Think of it as your autonomous compliance partner, one that eliminates manual research, standardizes your risk framework, and ensures every onboarding decision is backed by evidence, not guesswork. It keeps your institution protected, your compliance process consistent, and your onboarding pipeline moving at the speed of business.

The Challenge It Solves

Traditional customer due diligence is manual, slow, and inconsistent, often missing nuanced reputational and financial crime risks that standard checks can't detect. This creates onboarding delays, compliance gaps, and exposes institutions to regulatory penalties and reputational damage. Manual processes also make it impossible to systematically screen large customer volumes or identify risk patterns across entire customer segments.

How It Works

The Sevva AI Customer Due Diligence Agent functions as a fully autonomous risk screening analyst.

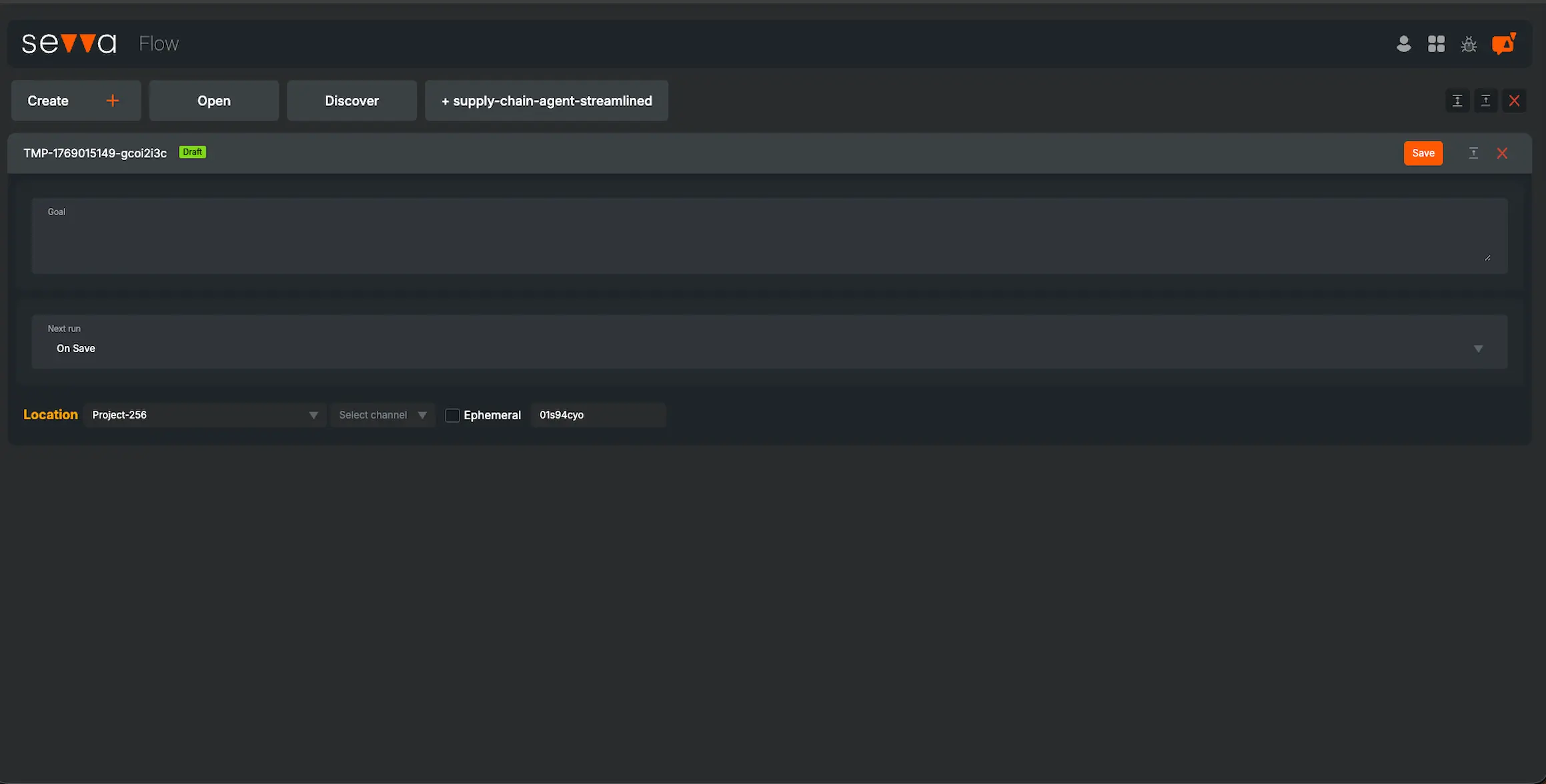

You define your internal risk and compliance policies as custom criteria, specify the customer or customer segment for screening, and the agent handles the rest. It automatically analyzes the customer's internal and external information against your specific risk policies.

The agent extracts structured risk signals, flags potential issues, and creates a comprehensive due diligence record with full auditable attribution. For high risk cases, it provides narrative evidence to support Augmented Due Diligence investigations.

In hours, you receive a complete, auditable risk assessment that would typically take analysts days or weeks to compile.

Core Capabilities

Custom Risk Criteria Definition. Configure your internal risk and compliance policies as specific screening questions tailored to your institution's requirements. Alternatively, let the AI Agent define criteria automatically.

Global Customer Screening. Perform enhanced due diligence on any customer, public or private, anywhere in the world using publicly available data sources

Systematic Risk Pattern Detection. Uncover hidden risks at scale by identifying systemic patterns across entire customer segments that are invisible at the individual level

Augmented Due Diligence Support. Generate structured risk flagging output with narrative evidence for deeper investigation and regulatory reporting

Auditable Documentation. Create consistent and fully traceable due diligence records that meet regulatory standards and support compliance audits.

Due Diligence Report Generation. The Agent synthesizes benchmarking results and strategic signals into a structured Due Diligence Report, showing the alignment of your target customer universe with your due diligence criteria.

Quick Start Checklist

Define Your Risk Criteria. Configure your institution's specific risk and compliance policies as screening parameters

Set Customer Scope. Specify individual customers, customer segments, or entire portfolios for systematic screening and ongoing monitoring.

Review Risk Assessment Reports. Access auto generated due diligence reports showing risk flags, supporting evidence, and recommendations, all linked to original source documents for audit trails.

Who It's For

The Customer Due Diligence Agent is ideal for:

Heads of Client Onboarding and Compliance at financial institutions who oversee customer due diligence, KYC, and risk management processes.

Chief Risk Officers who need systematic visibility into customer risk exposure across the entire institution.

Compliance Teams tasked with meeting regulatory requirements while accelerating legitimate business onboarding.

AML and Financial Crime Units looking to enhance detection capabilities and improve investigation efficiency.

Relationship Managers who need to balance risk management with customer experience and onboarding speed.

Why You Should Hire This Agent

Transform due diligence from a compliance hurdle into a strategic function.

Onboard the Right Customers, Faster. Stop choosing between speed and thoroughness. The agent delivers comprehensive risk assessments in hours, not weeks, allowing you to accelerate legitimate business while maintaining the highest due diligence standards.

See the Risks. Your Standard Checks Are Blind To Go beyond basic KYC and sanctions screening to uncover nuanced reputational risks, beneficial ownership concerns, and emerging financial crime patterns that traditional checks miss entirely.

Gain Systematic Risk Intelligence. While competitors rely on manual, inconsistent processes, you'll have systematic visibility into risk patterns across your entire customer base, enabling proactive risk management and strategic portfolio decisions.

- Accelerated customer onboarding

- Enhanced due diligence

- Systematic risk screening

- Analyse data from 200m+ companies globally